FiscalFriend

COMPETITIVE ANALYSIS • REQUIREMENT WRITING • WIREFRAMES• HIGH-FIDELITY PROTOTYPE • AI

The FiscalFriend financial app is a high-fidelity prototype created for the course INFO 693 at Drexel University’s College of Computing and Informatics.

OVERVIEW

Despite the availability of numerous financial management tools, many individuals still struggle with effectively managing their finances due to the complexity of budgeting, investment decisions, and expense tracking. Existing solutions often lack personalized guidance, simplicity, and automation, leaving users overwhelmed and prone to financial instability. Therefore, there is a need for an AI-powered financial app that offers personalized guidance, simplified budgeting, tailored investments, and automated expense tracking. The challenge is to develop a user-centric application that empowers individuals to make informed financial decisions, achieve their goals, and improve their overall financial well-being.

PROCESS AND LEARNINGS

Through a comprehensive approach that combined market research, one-on-one interviews, and competitive analysis, my partner and I gained valuable insights into user needs and industry standards. We initially developed a list of requirements and a prototype reflecting our findings and hypotheses about what users might need and appreciate.

To refine our requirements and prototype, we conducted several rounds of user testing. This process involved presenting our prototype to a diverse group of potential users, collecting their feedback, and observing their interactions with the product. Each round of testing brought forth crucial data, helping us identify strengths to build on and weaknesses to address.

Based on the feedback and our observations, we iteratively enhanced our prototype. This involved making adjustments to the design, functionality, and usability, always aiming to align more closely with user preferences and competitive benchmarks.

After multiple iterations and continued testing, we finalized our product design. This final product was the culmination of rigorous testing and refinement, designed to offer a superior user experience and a competitive edge in the market. We proposed this version as our definitive solution, ready for the next steps toward market launch.

TEAM

Chelsea Edington and Max Lupoli

INITIAL DESIGN SKETCHES

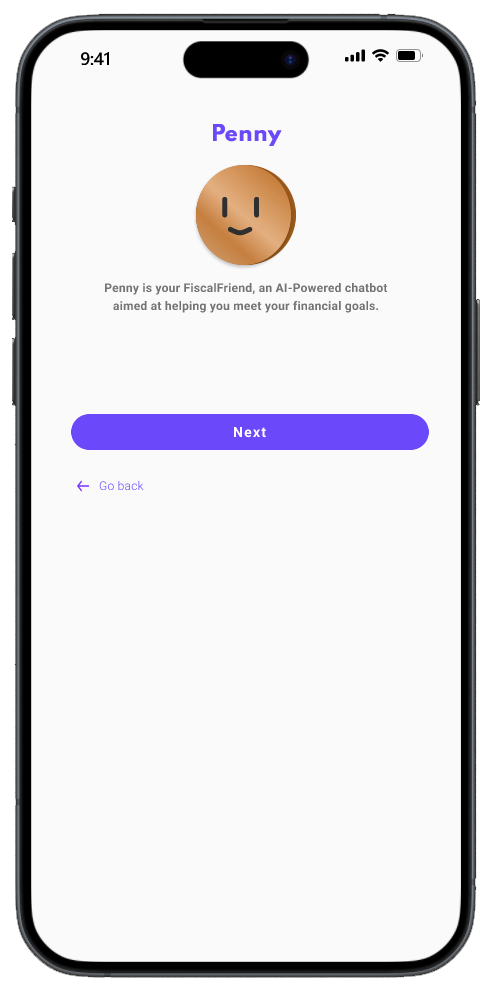

LOGIN & ONBOARDING INTERFACE

KEY FEATURES

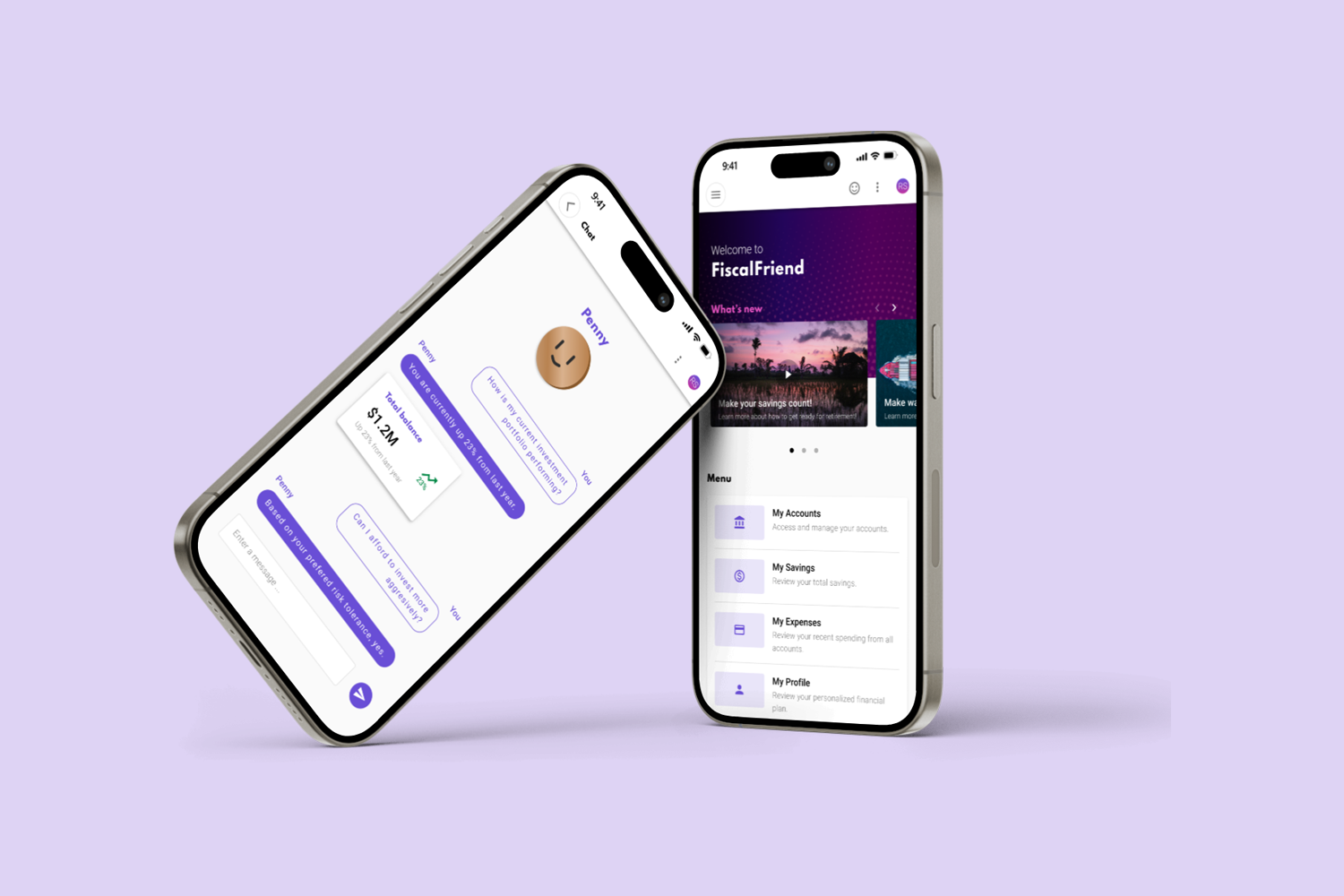

To address these challenges, we propose an AI-enhanced personal financial advisor that provides intelligent, personalized financial guidance, simplifies budgeting, offers tailored investment recommendations, and automates precise expense tracking. The system will utilize natural language processing (NLP) to interact with users through natural language conversations, machine learning to analyze financial data and generate personalized insights, and predictive analytics to provide tailored investment recommendations.

FINANCIAL INSIGHTS

PERSONALIZED FINANCIAL PLANNING

Provide regular reports and insights on spending habits, investment performance, and savings opportunities.

Create personalized financial plans based on each user's income, expenses, goals, and risk tolerance.

BUDGETING AND EXPENSE TRACKING

INVESTMENT RECOMMENDATIONS

Offer investment suggestions aligned with user financial goals and market analysis.

Enable users to set budgets, track expenses, receive alerts and insights, and automate expense tracking through integrations with financial institutions.

NATURAL LANGUAGE INTERACTION

Allow users to ask financial questions and receive understandable responses through natural language conversations.

GENERAL APP INTERFACE

POTENTIAL ETHICAL ISSUES & LIMITATIONS

Through our exploratory research, we identified the following potential ethical issues and limitations:

WEAK SECURITY PROTOCOLS

It is difficult for cybersecurity to keep up with the rapid evolution of AI technology. This may put confidential client information at risk if a financial institution’s AI system is not secure.

LACK OF EMPATHY

AI cannot build an emotional connection with clients, leading to a potential lack of trust in the relationship. This is especially dire in times of financial hardship, where it is important to empathize with the client before assisting them in making necessary financial changes.

LACK OF TRANSPARENCY

If users cannot trust the AI system, it will not succeed. All financial advice from the model is supported to the best of its ability through Insights and Reports, viewable from the user’s dashboard, which fully explains the model’s reasoning based on the user’s financial history and spending habits.

UNRELIABLE ADVICE

Due to the vast amount of deceptive financial news available on the internet, there is a chance that the AI system’s capability to make sound financial decisions may be put at risk.

ENVIRONMENTAL COST/IMPACT

AI technology and the resources needed to power it can be very taxing on the environment. This could pose sustainability risks to the financial world as a whole, hindering potential investment opportunities.

POTENTIAL MARKET FLUCTUATIONS

AI cannot accurately predict when the market may shift negatively, leading to a potential loss in client assets.

CHAT WITH PENNY INTERFACE

FINDINGS

The research undertaken into the development of an AI-enhanced personal financial advisor highlights the critical need for innovation in the field of personal finance management. Our research shows that traditional systems often fall short in delivering personalized guidance and proactive recommendations, leaving users to navigate the intricacies of financial management alone.

Artificial intelligence and machine learning have emerged as promising solutions capable of analyzing vast financial datasets and offering valuable insights. However, the ethical handling of user data and the establishment of trust are of paramount importance. Ensuring data security and privacy, as well as maintaining user trust, will be fundamental to the development and adoption of an AI-enhanced personal financial advisor.

VISUAL DEMONSTRATION

Royalty free music provided by Loksii